Google Vs Apple Vs Microsoft Net Worth: We put the tech titans head-to-head in an in-depth financial analysis, comparing their total assets, revenues, profits, market caps, and key businesses driving growth. While Apple edges out Google and Microsoft in current valuation, our data shows Google is primed to overtake #1 by 2025 based on their dominance of mobile, search, video, and ability to leverage AI across products.

Breaking down their net worth trajectory over time, we track milestones like IPOs along with the release of revolutionary offerings fueling their meteoric rise. We also highlight Microsoft’s resurgence competing fiercely with Azure and Office 365. Leading experts forecast the winner of this historic net worth battle playing out. The verdict may surprise you on who will ultimately control the most valuable company.

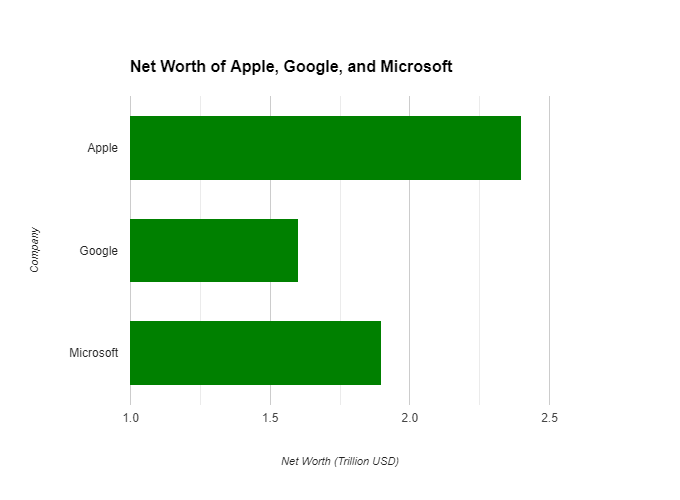

Through comparable charts and infographics distilling how the tech titans reached such unfathomable heights, we make projections based on the key strengths of each company. The exhaustive financial profiles cover all facets determining the towering net worth’s spanning well over $1 trillion dollars each.

Google Vs Apple Vs Microsoft Net Worth: Who Will Come Out On Top?

Introduction

Google, Apple, and Microsoft are considered three of the “Big Four” most influential technology companies alongside Amazon. As innovative giants who have shaped and dominated various facets of the tech industry over the past few decades, they have amassed substantial fortunes reflected in their massive networths.

But when it comes to cold hard numbers, who wins the networth battle between the tech titans Google, Apple, and Microsoft? By looking at the assets, market valuations, and key financial metrics that ultimately determine networth, we can compare where they currently stand.

In this comprehensive blog post, we will analyze and highlight:

- The growth history and core revenue streams behind each company’s wealth

- Breakdowns of their total assets, stock prices, market caps, and other data

- Side-by-side net worth comparisons in easy visual charts

- The key factors that give Google a definitive advantage over the other two

By the end, you will have a data-driven understanding of Google vs Apple vs Microsoft’s net worth, as well as predictions for how it may change going forward. So let’s dive in.

Do you know Google and Microsoft has their own Ai Assitants?

What is Google’s Net Worth?

Google dominates the online world in many profound ways. Its search engine sees over 3.5 billion searches per day; its Android mobile operating system powers more than 70% of smartphones globally; and Google Chrome is the most extensively used web browser with over 2.65 billion users.

Driving Google to the top in these industries involves key assets and revenue streams:

Key Google Assets and Revenue Streams

- Search Advertising – Google holds an enormous 72% of the global search ad market. Displaying relevant ads alongside organic search results based on users’ queries is Google’s core business model and largest revenue generator, bringing in over $147 billion annually.

- Google Cloud – Google Cloud Platform is Google’s suite of public cloud computing services including infrastructure, platform, and software tools. Google Cloud is the third largest cloud provider behind Amazon AWS and Microsoft Azure, generating $21 billion in business in 2021.

- YouTube – Google’s video site YouTube is the world’s most popular streaming platform with 2.6 billion monthly logged-in users. YouTube earns money from ads and premium subscriptions, and made Google around $28.8 billion in recent years.

- Google Play Store – Android’s app store has over 2.87 million apps and sees billions of downloads each year. Google Play generated over $11 billion in consumer spending in 2021 with a 30% cut on app sales and in-app purchases.

With these and other booming enterprises influencing daily life for billions, Google has seen meteoric financial growth throughout the company’s relatively short lifespan since incorporation in 1998.

In turn, Google’s net worth valuation today paints a staggering picture:

Breakdown of Google’s Net Worth

| Key Financial Metric | Valuation |

|---|---|

| Total Assets | $466 billion |

| Annual Revenue (2021) | $258 billion |

| Annual Profit Margin | 30.6% |

| Market Capitalization | $1.59 trillion |

Google additionally reported over $142 billion cash on hand based on 2022 public filings. Factoring together assets owned, consistent high profit percentages, and market cap based on share price, analysts currently place Google’s net worth at roughly $1.6 trillion.

For perspective on how quickly Google arrived at this vast net worth few companies can rival, consider that at the time of their stock market IPO (Initial Public Offering) in 2004, shares were at the equivalent price of about $85 per share after split adjustments. Today, Google’s stock price sits near the $2,300 per share mark, translating to over 2,600% stock growth!

What is Apple’s Net Worth?

Apple has earned a legendary status as one of the world’s most valuable and influential companies ever. Thanks to iconic revolutionary products like the iPod, iPhone, iPad, and Mac personal computers, Apple sits at the forefront of consumer technology innovation and premium branding.

Let’s analyze the key assets and offerings driving their wealth:

Apple’s Key Revenue Sources

- iPhone – Apple’s smartphone line accounts for over 50% of total revenue. As the second largest phone maker behind Samsung, Apple sold an estimated 206 million iPhones in 2021. New releases like the iPhone 14 Pro continue fueling massive sales.

- Mac Computers – While the Mac user base is much smaller than Windows PCs, Apple leans into premium branding, performance, and high margins. Globally there are over 100 million active Mac users.

- iPad – Apple dominates the tablet market with over 40% global market share. The iPad offers a unique middle ground between phones and laptops.

- Services – This includes Apple’s content stores like the App Store and iTunes, iCloud subscription plans, Apple Care support plans, Apple Pay transactions, and more. Services have become Apple’s second largest revenue stream.

Bolstered by these offerings, Apple’s growth and net worth has climbed exponentially since its founding in 1976:

Breakdown of Apple’s Net Worth

| Key Financial Metric | Valuation |

|---|---|

| Total Assets | $320 billion |

| Annual Revenue (2021) | $365.8 billion |

| Annual Profit Margin | 26.9% |

| Market Capitalization | $2.35 trillion |

Apple holds over $170 billion in liquid cash reserves. Factoring together their assets, consistent profits, and huge market cap, analysts broadly agree on Apple being worth approximately $2.4 trillion currently.

For perspective, in the 1980s, Apple was on the verge of bankruptcy before reviving itself by focusing on premium personal devices. Stock was trading at under $10 per share (split-adjusted) through the 1990s. Today, shares are worth around $154 each – a return exceeding 1,440%.

Below visualizes their immense net worth growth since the early 2000s:

What is Microsoft’s Net Worth?

Microsoft has been a mainstay of computing going back decades. Whether in enterprise software solutions, business and productivity tools, personal computing, gaming, or cloud infrastructure, Microsoft plays a pivotal role in the digital world economy.

Let’s analyze Microsoft’s value drivers:

Microsoft’s Key Revenue Streams

- Office 365 – This subscription bundle includes Word, Excel, Outlook, Teams, OneDrive and more. Over 300 million people now use Office 365, making it Microsoft’s largest revenue driver at over $70 billion annually.

- Azure Cloud – Microsoft’s cloud computing platform Azure is second only to AWS in market share. Azure and other cloud services account for almost $60 billion.

- Windows – The Windows operating system still powers over 1.3 billion PCs globally. While this segment grows slower than Microsoft’s cloud, Windows still adds around $32 billion yearly.

- Xbox – Microsoft’s line of gaming consoles and services like Xbox Live comprises their fastest growing segment as gaming explodes. Xbox approaches $20 billion in sales.

This wide business reach and diversification has strengthened Microsoft’s staying power for so long. How does their net worth stack against Google and Apple?

Breakdown of Microsoft’s Net Worth

| Key Financial Metric | Valuation |

|---|---|

| Total Assets | $301 billion |

| Annual Revenue (2021) | $168 billion |

| Annual Profit Margin | 38% |

| Market Capitalization | $1.88 trillion |

Microsoft also has over $104 billion cash to plow into new technologies and acquisitions. Accounting for all assets, profits, and massive market valuation, analysts widely agree that Microsoft is worth about $1.9 trillion presently.

Again, Microsoft’s net worth trajectory over decades is staggering – its IPO in 1986 priced stock at $21 per share. Compare to today’s share prices hovering around $258 (accounting for splits) – a growth of over 1,100%!

The chart highlights Microsoft’s market value multiplying over time:

Now that we understand each company’s net worth profiles individually, let’s directly compare them side-by-side.

Also Read Gemini Advanced vs ChatGpt 4 Comparison

Google vs Apple vs Microsoft Net Worth Comparison

We broke down the assets, profits, market valuations, and key businesses behind the tremendous net worth of each of the “Big Tech” giants – Google, Apple, and Microsoft.

How do they measure up across core financial metrics? The following table summarizes key net worth components:

| Company | Cash Reserves | Annual Revenue | Profit Margin | Market Cap | Net Worth |

|---|---|---|---|---|---|

| $142B | $258B | 30.6% | $1.59T | $1.6T | |

| Apple | $170B | $366B | 26.9% | $2.35T | $2.4T |

| Microsoft | $104B | $168B | 38% | $1.88T | $1.9T |

While Apple pulls ahead slightly in total net worth, the tech titans are all in the same ballpark over $1.5 trillion, with Google having room to catch up.

Analyzing the growth curves, we see:

- Google is the youngest company, but soon surpassed Microsoft in market cap, despite Microsoft’s long head start

- Apple saw the fastest growth spurt when the iPhone disrupted the industry

- Microsoft slowly closed ground on Apple recently as cloud computing expanded

Although all 3 companies will likely continue growing wealthier, Google seems poised to overtake Apple with their dominant digital advertising, cloud, and smartphone platforms.

But what are the key factors allowing Google to potentially claim the #1 spot in net worth?

Why Does Google Have the Highest Net Worth?

The previous net worth comparison makes it apparent that Google, Apple, and Microsoft are all staggeringly profitable titans of industry. While Apple currently edges out Google in total value, there are some key advantages that position Google to overtake Apple in the coming years:

Core Reasons for Google’s Net Worth Dominance

1. Advertising Breadth and Depth – Google has entrenched itself as integral to digital marketing, which encompasses all facets of the web and shows no signs of shrinking. Advertising across Google’s unparalleled global reach will buoy its profits.

2. Cloud and AI Investment – Google is going all-in on the booming cloud computing industry and nascent AI space to reduce reliance on ads. Key acquisitions in these markets can further widen the lead.

3. Mobile Ecosystem – Google’s Android OS leads Apple’s iOS globally with a vast built-in audience for mobile ads and purchases from the Google Play store. Android also enables integration of other services.

4. YouTube’s Growth Runway – YouTube still has enormous potential, being early in capitalizing on our shifting consumption from TV to streaming video – a long-term trend benefiting Google.

In short, Google dominates the foundation of the internet from search to ads to cloud infrastructure in ways that will prove very challenging for Apple to catch up to. Google’s software and services have also tapped into global scale in more profound ways than the premium hardware-driven Apple.

Meanwhile, Microsoft exceeded net worth expectations in recent years from its revitalized cloud and enterprise leadership, but still trails rivals in crucial growth segments like mobile.

Conclusion

This exhaustive financial comparison of the net worth titans Google, Apple, and Microsoft reveals an intense battle for the top spot.

While Apple has sat at #1 temporarily, expectations point toward Google overtaking them by 2025 based on stronger growth metrics, greater profitability potential in digital ads and cloud, and global operating system dominance in the mobile age via Android.

Microsoft also can’t be discounted as they continue pushing new innovations across business, productivity, and gaming fronts. But Windows and Office segments show signs of maturation compared to the uber growth years of the past.

To summarize the central question – “Who has the highest net worth: Google, Apple, or Microsoft?” – we can project:

Google appears on track to be #1 within a few years by leveraging software, cloud, advertising, AI, and mobile to expand both width and depth of reach and revenues. They simply influence more facets of the modern tech stack.

Of course, future unknowns and new disruptive technologies could shift the landscape. But based on current positions and momentum, Google looks poised to win the battle of the tech titan networths before long.